Looking for Better Community Association Insurance?

We've got you covered

Looking for Better Community Association Insurance?

We've got you covered.

Being a top-tier independent insurance agency, our primary focus is always on meeting the needs of our clients. Through our vast network of trusted insurance providers, we can secure the most competitive rates while maintaining high-quality coverage. Whether you require insurance due to legal requirements or seek comprehensive protection like Fidelity/Crime, Excess Liability, and Workers' Compensation, our skilled team is ready to help. RealManage Insurance Services offers personalized insurance solutions tailored to your immediate needs and future risks, ensuring you can rest easy knowing your community is fully covered.

Why RealManage Insurance Services?

![]() Insurer rated A++ XV by A.M. Best Company

Insurer rated A++ XV by A.M. Best Company

![]() We specialize in insurance for HOAs, condominiums, townhomes, and mixed-use community associations.

We specialize in insurance for HOAs, condominiums, townhomes, and mixed-use community associations.

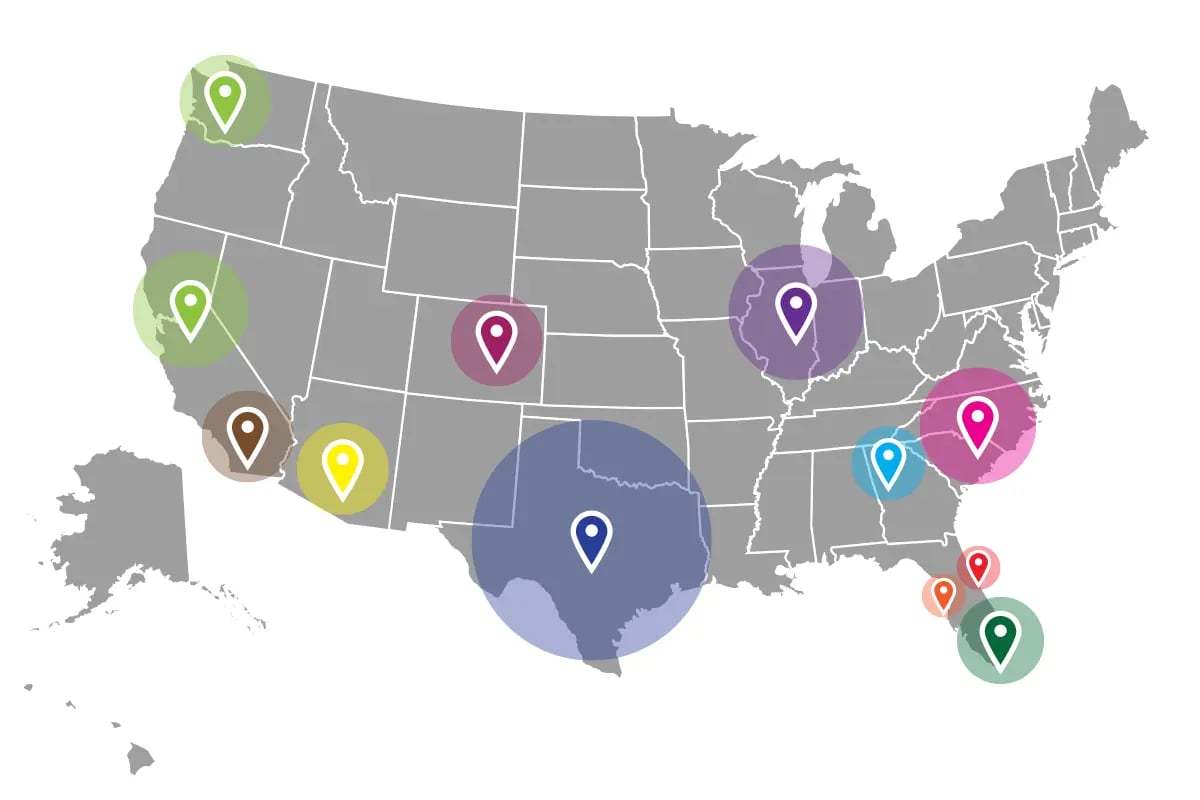

![]() California (License #0H31913), Colorado, Florida, Illinois, North Carolina, Texas, and Washington

California (License #0H31913), Colorado, Florida, Illinois, North Carolina, Texas, and Washington

![]() We offer a Single-Family Package Program

We offer a Single-Family Package Program

Being a top-tier independent insurance agency, our primary focus is always on meeting the needs of our clients. Through our vast network of trusted insurance providers, we can secure the most competitive rates while maintaining high-quality coverage. Whether you require insurance due to legal requirements or seek comprehensive protection like Fidelity/Crime, Excess Liability, and Workers' Compensation, our skilled team is ready to help. RealManage Insurance Services offers personalized insurance solutions tailored to your immediate needs and future risks, ensuring you can rest easy knowing your community is fully covered.

Why RealManage Insurance Services?

![]() Insurer rated A++ XV by A.M. Best Company

Insurer rated A++ XV by A.M. Best Company

![]() We specialize in insurance for HOAs, condominiums, townhomes, and mixed-use community associations

We specialize in insurance for HOAs, condominiums, townhomes, and mixed-use community associations

![]() California (License #0H31913), Colorado, Florida, Illinois, North Carolina, Texas, and Washington

California (License #0H31913), Colorado, Florida, Illinois, North Carolina, Texas, and Washington

![]() We offer a Single-Family Package Program

We offer a Single-Family Package Program

Why should I partner with RealManage?

![]() We are GROWTH oriented...

We are GROWTH oriented...

We never look to cut costs to make deals fit in a one-size-fits-all model

![]() We are in the PEOPLE business!

We are in the PEOPLE business!

People are what makes RealManage, well... real. Our people drive our culture, and we take care of our people!

![]() We are flexible...

We are flexible...

With integration vs. stand-alone In regards to both structure and terms

![]() Check our references...

Check our references...

We will be glad to introduce you! We have several key team members from our acquisitions who would be happy to chat with you.

Let’s grow together

Are you ready to get started and explore the benefits of joining the RealManage Family of Brands?

Our executive team is available to assist you. We encourage you to give us an opportunity to assist you with your efforts to determine the best course of action for your business to develop a potential partnership with one of the fastest-growing management companies in the nation.

Understand Your Community Insurance Needs

Navigating the intricacies of community association insurance requires a proactive approach, especially when it comes to evaluating your community's loss history and the strategic benefits of insurer loyalty. Annual reviews of updated loss runs are essential, providing insights into claim developments and losses reported post-policy expiration. While the urge to seek multiple bids annually for policy renewals is common, it's crucial to recognize the niche nature of community association insurance, where options might be limited. Let us guide you through these complexities and help secure an insurance solution that values your community's history and fosters a lasting partnership. Reach out for a personalized quote and safeguard your association with the expertise it deserves.

Single-Family Package Program

Property: "Blanket Basis" 2 groups, no coinsurance

General Liability: $1,000,000/2,000,000

OPTIONAL

Quotes will include these coverages:

Non-owned Auto Liability:

$1,000,000/2,000,000

Cyber Liability | Data Breach Liability:

$10,000

Privacy Liability:

$25,000

Crime | Employee Theft:

$50,000

REQUIREMENTS

Signed application, plat, or community map

Loss runs: Only if there has been a loss within five years

Premiums are payable in full or in installments.

Package Policy Extras

Business Income*

Back-up of water/sewer

Building Ordinance or Law

Equipment Breakdown

Waiver of Subrogation+

*actual loss sustained up to 12 months

+ available for $50.00 additional premium

*Disclaimer: none of the information provided on the website page is a guarantee that insurance will be provided or that the agency is obligated to procure insurance for the website visitor.*

COMMUNITY ASSOCIATION INSURANCE TYPES

General Liability (CGL) - This insurance protects against claims others may make against the association. The four coverages provided are bodily injury, property damage, personal injury, and advertising injury. Coverage applies to accidents that occur during the policy and are subject to policy limits. Homeowners are also covered as additional insureds. There is usually no deductible.

Directors & Officers (D&O) - Disputes can and do arise over assessments, liens, and DRV's. D&O protects the association and its directors from claims of mismanagement. Coverage is provided for claims that are made against the association during the policy period, subject to the 'prior claims' or retroactive date. A deductible for each claim applies.

Commercial Property Insurance - Most associations have some commonly owned property. The property should be insured for its full replacement cost. This is likely not the same value that is on a reserve study which identified the cost to repair various items. It is important to have and review at Statement of Values every year. Property is subject to a deductible per claim. Often there is a separate, higher deductible for wind/hail. A wind/hail deductible buy-down may be available.

Fidelity/Crime - This coverage protects against the theft of cash by an employee - which, for community associations, includes directors, officers, and volunteers. The FHA and some states require condos and other community associations to carry this coverage with the management company named an additional insured.

Non-owned Auto - This insurance protects the HOA in the event someone who is driving on association business is involved in an accident and does not have adequate insurance to pay for all the damages.

Workers' Compensation - Many associations do not have employees. However, some courts have held homeowners associations responsible for paying workers' compensation benefits to employees of uninsured vendors injured while working for the association. Insurance is available that provides no-fault medical coverage if volunteers, board, or committee members working at the board's direction get injured.

Umbrella/Excess Liability - This policy provides additional limits of insurance for liability claims, Coverage should be excess of commercial general liability, auto liability and D&O. Every association should consider this relatively inexpensive additional coverage.

Get a Free HOA Management Assessment

Elevate your HOA’s operation to new heights with professional HOA management!